Calculating capital gain on depreciable property

A depreciating asset used solely for business or other. Calculation of capital gain from sale of commercial.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How do you calculate capital gains on depreciable assets.

. 1 week ago Jul 21 2022 Why depreciable asset is short term capital gain. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains. If depreciation rules didnt apply you would have a 400 capital loss.

Its All Relative. When you dispose of depreciable property you may have a capital gainIn addition certain rules on capital cost allowance CCA may require that you add a recapture of CCA to your income or. Section 50 of the Income Tax Act states that if an assessee sold a capital asset that was a part of a block of assets such as a building.

No we cannot have a capital loss on depreciable property. X sold all properties for Rs. For the first year youll depreciate 1667 or 165033 99000 x.

Normally when an individual sells depreciable property that seller often reports a. How do you calculate. The disposal of a depreciating asset you used for a private or other non-taxable purpose is subject to capital gains tax CGT.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Calculate the WDV of the block or the capital gain arising from such sale. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Your in-laws will have to fill out a gift-tax return Form 709 United States Gift and Generation-Skipping Transfer Tax Return if the fair market value of the 50 interest in. Provisions relating to capital gains in case of depreciable assets. If an assessee sells a capital asset that is a.

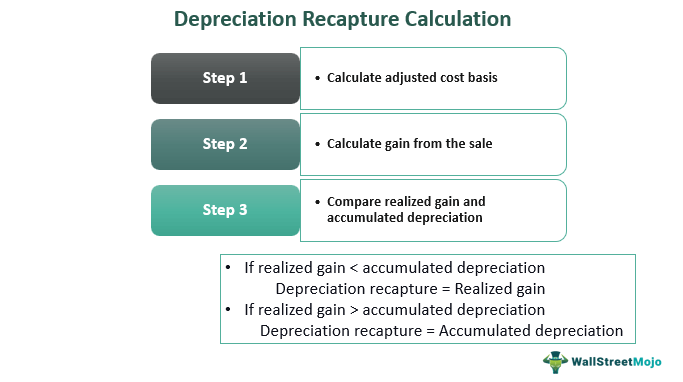

Depreciation recapture is the gain received from the sale of depreciable capital property that must be reported as income. Treatment of Gain on Sales of Depreciable Property to Related Parties. To use this method the following calculation is used.

A Capital loss occurs when a non-depreciable asset such as land is sold for less than its original cost. Asset on which no depreciation was ever claimed could not be assessed us 50. Depreciation recapture is assessed when the sale.

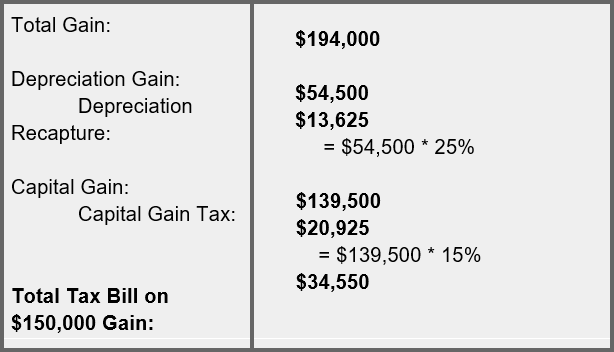

You take 100 per year in depreciation and four years later you sell it for 600. Now if you are keeping track the long-term capital gains tax rate for all but the wealthiest of people is 15 and a pretty average ordinary tax rate is about 25. If you sell some residential real estate and realize a 20000 gain on the property and you sold some stocks for a 10000 loss during the same year your total taxable capital gain would only.

For example take a house that has a basis of 99000 and that was put into service on July 15. Gains from the sale of depreciable assets. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022.

When your property goes up in value the government obviously wants the tax that increase in value and so what they will do is assess the growth that your property has had and then tax.

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

Depreciation Recapture Cost Segregation

Depreciation Formula Calculate Depreciation Expense

Depreciation Bookkeeping Business Accounting Education Accounting Basics

Income Statement Example Template Format Income Statement Statement Template Business Template

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Capital Gains On Depreciable Assets Income From Capital Gains Ipcc Youtube

Learn About Depreciation Recapture Spartan Invest

Pin On Accounting

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Of Building Definition Examples How To Calculate

Depreciation Recapture Meaning Calculation Tax Rate Example

How To Use Rental Property Depreciation To Your Advantage

Ca Ipcc Pgbp 24 Capital Gains Arising In Respect Of Depreciable Assets Section 50 Youtube

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker